New provisions and guidelines for public land energy leasing will conserve habitat, improve transparency, and benefit taxpayers

In November of 2021, the Department of the Interior released a report on public land oil and gas leasing that included specific recommendations for ensuring more responsible development of these critical resources. The TRCP published a blog supporting several of the report’s recommendations that would create new efficiencies in the process while also conserving quality fish and wildlife habitat.

Last week, the Bureau of Land Management, the agency responsible for the leasing and development of federally owned mineral resources, announced its intent to complete the first oil and gas lease sale of the Biden Administration. Scheduled for June 2022, the upcoming sale will include several important changes to the federal leasing program.

Among other changes, the BLM will:

- Ensure public participation and Tribal consultation in the leasing process. Given the public and Tribal resources at stake, it only makes sense for Tribes and the public to have a voice in the process, and the BLM announced steps to facilitate this involvement.

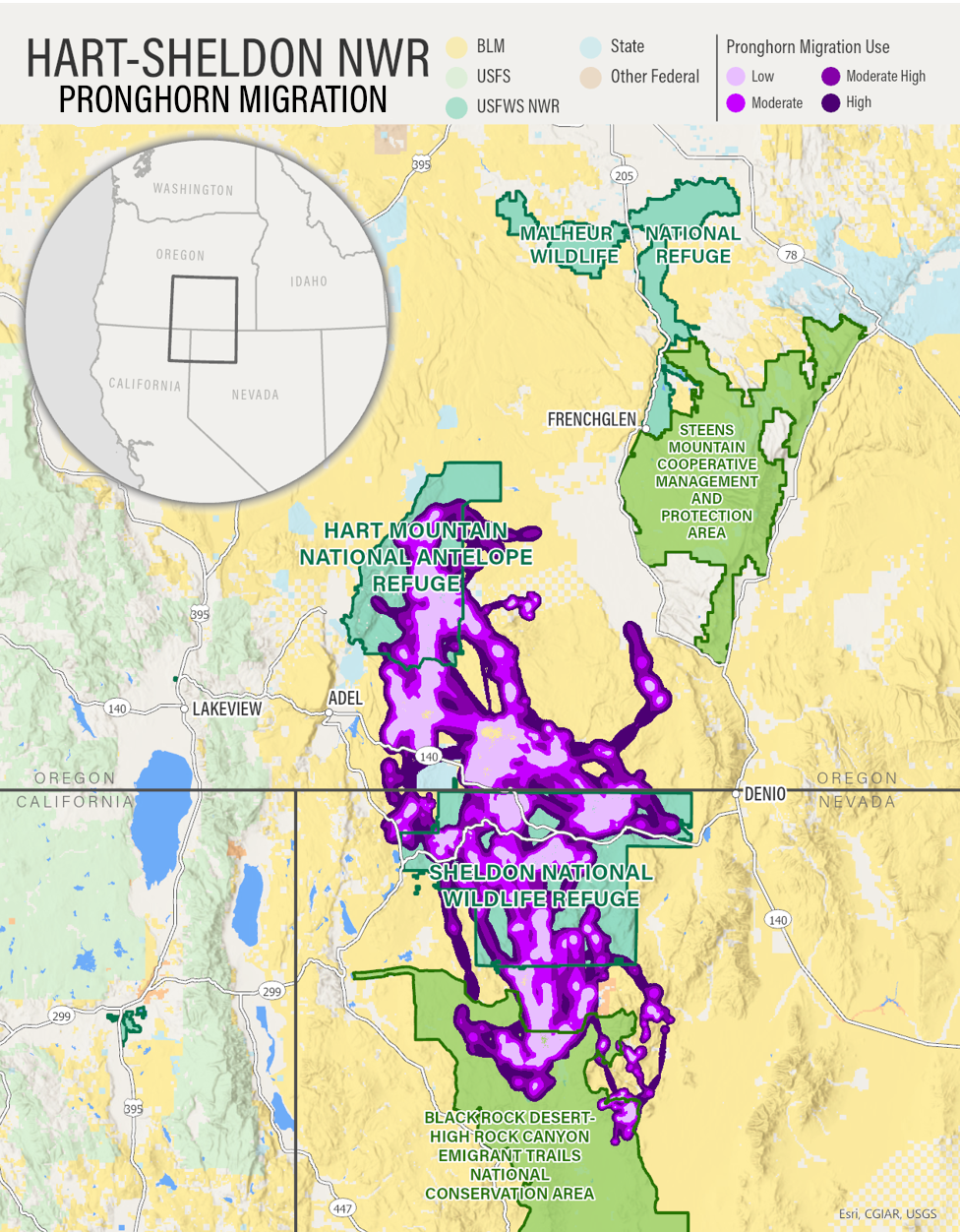

- Avoid leasing in lands with low potential for development. It makes no sense to lease public lands and important wildlife habitats in places where there is little actual chance that economically viable development will take place. Moving forward, the BLM will avoid leasing in these low-potential areas and focus leasing in places where viable energy resources are known to exist.

- Concentrate leasing near existing development. Leases sold in areas with existing oil and gas infrastructure are more likely to be developed, and they are also likely to be sited in locations where impacts from development have already occurred. Leasing near existing development is a common-sense measure that will help avoid the fragmentation of important habitats where development does not exist.

- Increase the royalty rate to 18.75% for leases sold. Increasing the royalty rate from 12.5%—a rate that was set in 1920—brings the federal price in line with state and private rates. This market-adjusted royalty will improve the rate of return to taxpayers.

It is important to note that these actions by the BLM and Interior Department will not have any short-term effect on the price of gasoline. There should be no doubt that TRCP supports affordable energy for American consumers—particularly the oil and gas we rely on to power our cars and heat our homes—while also working to increase the availability of renewable energy resources as the U.S. transitions to a more climate-friendly economy. TRCP fully recognizes that the ongoing conflict in Ukraine and associated sanctions against Russia have created pain at the pump, with many consumers paying well over $4 per gallon of regular gas. But the availability of public land oil and gas leases, simply put, has no short-term bearing on the supply-and-demand curve of our energy sector.

The Interior Department’s own documents indicate that 13.9 million acres of federal minerals already under lease—more than half of the 26 million total federal acres presently leased—have not yet been developed by energy companies. Energy producers could develop these existing leases for many years into the future before the availability of public land oil and gas resources becomes an issue, and no existing policies prevent energy companies from developing their current holdings.

And while the recent BLM announcement is taking heat from both sides of the political aisle, the TRCP believes these changes are both balanced and necessary and we have advocated for them for many years. Leasing oil and gas resources in a way that involves the public, reduces impacts to sensitive habitats, and generates a fair rate of return for American taxpayers is common sense. We now hope the administration will take an equally thoughtful approach to expanding renewable energy resources in a way that takes into account these same considerations and conserves our best fish and wildlife habitat and public resources.

Top photo: USFWS via Flickr

Swallow the $ koolaid. The supposed “LAW of supply & demand” is only EconomicSpeak propaganda justifying GREED. Just because more consumers demand my product does NOT mean I HAVE TO raise my price, only that I can GET AWAY WITH IT ! (in this case outdated PETRO) The excuse of “supply chain issues” is absolutely NO DIFFERENT. Clean viable tech already exists for energy needs. Non-wildlife killing ROOFTOP vertical tube wind & solar (vs “farms”) usurps NO more unspoiled land and water. Vehicles running on compressed air are already available in EU. The Am. Petro Industr website carefully OMITS mention of the horribly polluting Haliburton Loophole proprietary chemicals used for fracking. Petro eschews potentially profitable methane capture to speed yr round Arctic drilling. They own too much of our government, buy up + develop and sequester cleaner tech. They profit IMMENSELY already while we still fork out cheap leases & subsidies and overlook unnecessary enviro destruction.

While I am pleased to see these long overdue oil and gas lease sale reforms, the reality is that the U.S. IS NOT dependent on Russian oil supplies. In 2021, the U.S. imported an average of 8% from Russia. The majority (61%) of our oil imports come from Canada! It is also important to note that these reforms are recommendations only, not mandates! Without mandates, there is no teeth in the game! The increase in the royalty rate to 18.75% from 12.5% after 100 years of no rate increases is a joke, particularly in lieu of the fact that the oil industry is subsidized by the U.S. government to the tune of around $20.5 billion annually! It is my belief that the Ukraine crisis is being egregiously exploited by the fossil fuel industry! Their price gauging is APPALLING! It is time to stop buying into all of the hysteria! It is a “dog and pony show” predicated upon pure greed on the part of the fossil fuel industry and a shameful political ploy on the part of the Biden administration!